Filings dropped 58 percent in the county from 2013 to 2014

By Tim Doran / The Bulletin / @Newsinbendor

Foreclosure filings dropped 58 percent in Deschutes County last year, according to figures from the county.

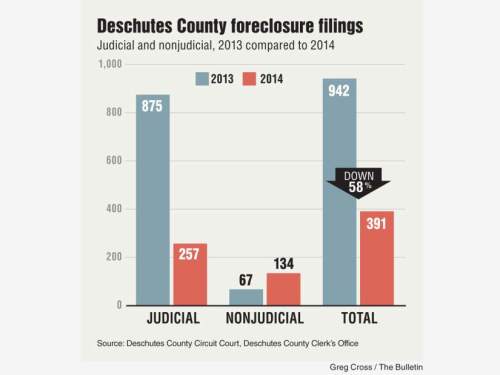

Total filings in Deschutes County fell from 942 in 2013 to 391 last year, according to figures from the circuit court and clerk’s office.

In 20 of the state’s 36 counties tracked by Eugene real estate company Gorilla Capital, total filings dropped 47 percent, from 13,446 in 2013 to 7,075 last year, figures from the company show.

Oregon’s foreclosure process has delayed a full recovery in the housing market, John Helmick, Gorilla Capital CEO, said in a news release earlier this month. He expects about 600 new foreclosures to be filed monthly in the first half of this year in the counties tracked by Gorilla, which buys foreclosed homes, redevelops and sells them.

New filings will start to decline in the second half of this year, he said in an interview last month, and more homes will complete foreclosure and get listed for sale.

Changes made to state foreclosure laws over two legislative sessions led to the delayed recovery, he said.

To get banks and lenders to meet with homeowners facing foreclosure, the state passed a law in 2012 requiring lenders to mediate with homeowners. But the law prompted lenders to essentially abandon the nonjudicial foreclosure process — known as advertisement and sale — and switch to judicial, sending their foreclosures into state courts. It also resulted in few face-to-face meetings between lenders and homeowners.

So in 2013 the state changed the law again to ensure more financial institutions would come to the table.

Each change, however, brought the foreclosure process to a crawl. As the housing industry adapted to the new rules, the process ramped up again, Helmick said in the interview.

“It’s like resetting the ceiling fan,” he said. “Turn it off. Wait for it to stop. Then start it on again.”

The changes in state law were public policy decisions, Helmick said, not characterizing them as good or bad. But they lengthened the foreclosure process and prevented the market from recovering as fast.

In Deschutes County, nonjudicial foreclosure filings — called notices of default — doubled year over year, from 67 in 2013 to 134 last year. Default notices are filed in the county clerk’s office, and not all end in foreclosure.

The big drop came in judicial foreclosures, with 257 filed last year in Deschutes County Circuit Court, compared with 875 in 2013, according to court figures.

Last year’s total, 391, still tops the number of filings in Deschutes County in the years before the real estate crash. The county recorded 310 default notices in 2005 and 221 in 2006.

But foreclosures in 2014 remained far below the levels reached in 2009 and 2010, when Deschutes County recorded 3,507 and 3,762 default notices filed, respectively.

Lynne McConnell, associate director of HomeSource at NeighborImpact, said her agency continues to see homeowners seeking foreclosure counseling.

“I believe there were eight new cases the week of New Year’s alone,” she said.

She attributed the decline in Deschutes County filings overall to rising home values in Bend, where homeowners behind on their mortgages may now sell their homes at a price that allows them to satisfy that debt. That advantage, she said, has yet to reach beyond the city.

“That’s very localized to Bend,” she said. “It hasn’t reached the outlying areas, which are still under water. The banks are still catching up on their filings, I think.”

— Reporter: 541-383-0360,

— Joseph Ditzler of The Bulletin staff contributed to this report.